|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

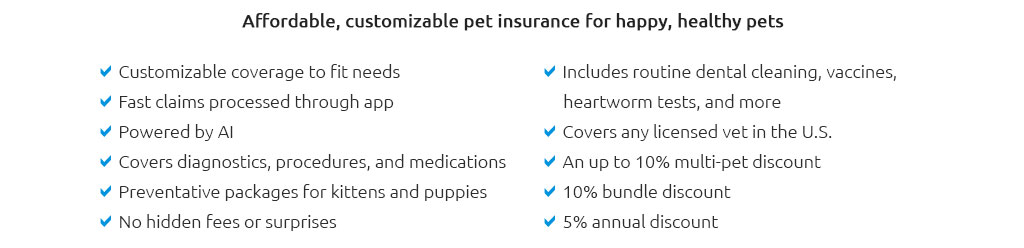

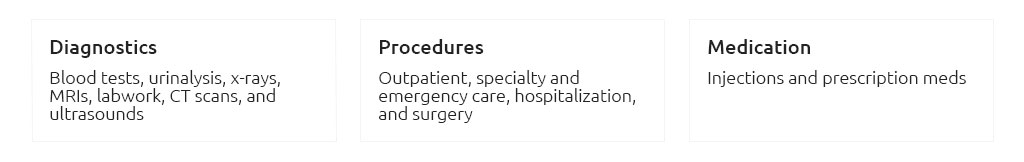

Understanding the Cost of Pet Insurance for Cats: A Comprehensive OverviewIn today's world, where our feline companions are more than just pets-they're family members-it's crucial to consider their health and well-being with the same seriousness as we do our own. One aspect that often comes into discussion is pet insurance, especially for cats, who, despite their reputation for independence and resilience, still face health risks and veterinary needs. But what exactly does pet insurance for cats entail, and how can we navigate its costs effectively? Firstly, understanding the core components of pet insurance is essential. It typically covers accidents, illnesses, and sometimes preventive care, although the latter is often an optional add-on. The price of these plans can vary significantly based on several factors, including the cat's age, breed, location, and the specific coverage options chosen. For instance, insuring a young, mixed-breed cat in a rural area might be more affordable than insuring an older purebred in an urban setting due to the differing risks and veterinary costs associated with these scenarios. When considering pet insurance, it's crucial to weigh the benefits against the costs. A common sentiment among cat owners is the peace of mind that comes from knowing unforeseen veterinary expenses won't become a financial burden. However, some argue that if a cat remains healthy, the premiums paid could exceed the benefits received. Therefore, the decision often boils down to one's financial situation and risk tolerance. To provide a clearer picture, let's delve into a typical cost breakdown. On average, insuring a cat can range from $10 to $50 per month, depending on the coverage level. More comprehensive plans, which cover a broader spectrum of incidents and treatments, understandably cost more. It's worth noting that while monthly premiums might seem like a regular expense, they can save owners from the shock of unexpected veterinary bills, which can run into thousands of dollars for surgeries or long-term treatments.

In conclusion, while pet insurance for cats involves a financial commitment, it is often seen as a valuable investment in their health and longevity. It's important for cat owners to thoroughly research and compare different plans, considering not just the cost, but the potential benefits and coverage details. After all, as any devoted pet parent would agree, ensuring the well-being of our beloved feline friends is priceless. https://www.reddit.com/r/CatAdvice/comments/n82h7q/cat_insurance_pros_and_cons/

$571/year premium, $250 deductible, includes emergencies, prescriptions and wellness (like nail clippings and whatnot). Honestly, I haven't used ... https://www.cnbc.com/select/pet-insurance-cost/

Cats cost slightly less: The average feline costs between $180 and $870 per year with emergency veterinary care adding up to $1,615. Fortunately, a good pet ... https://www.lemonade.com/pet/explained/pet-insurance-cost/

At Lemonade, a policy for a dog or a cat starts at $10/month. (Plus our affordable pet health insurance has won the approval of authorities like Money.com).

|